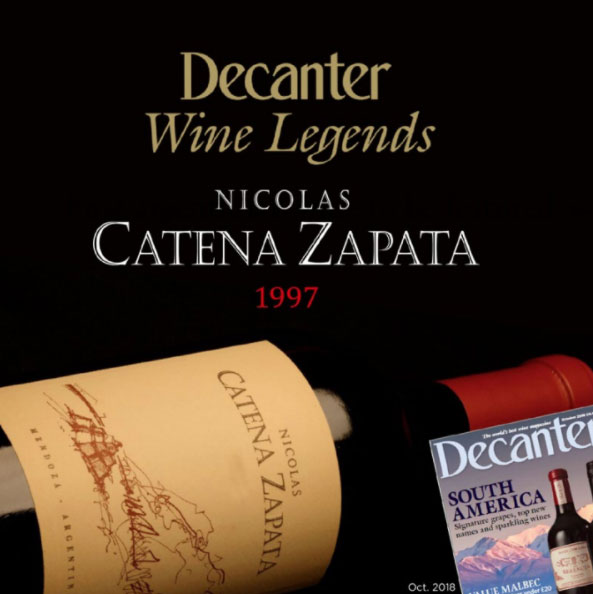

Nicolás Catena Zapata

A LEGEND BECAUSE…

It was Nicolás Catena who thrust Argentinian wine into the modern era. A widely travelled academic economist, he learned from his exposure in the 1970s both to great Bordeaux and the huge promise of Napa wines. In the early 1980s, Catena agreed the key was to plant the right varieties in the right location, specifically cooler, higher sites.

Decanter Wine Legend

“Nicolás Catena Zapata is justly credited with putting Argentinean wines on the world map—by the best expedient of focusing entirely on quality. It’s great to know he has started a wine dynasty, too.”

“It strikes me as being Argentina’s equivalent of a great vintage of Lafite-Rothschild.”

“This wine reminded me of a 2001 claret or a 2001 Napa Valley Cabernet; A beauty.”

> High-Altitude vineyards since 1902

> Argentina’s first Grand Vin

> Oldest Argentine family winery still in family hands

> Ungrafted vines

> Massale selections of Malbec and Cabernet that no longer exist in Europe

Nicolás Catena Zapata Crus

Adrianna Cru

Ungrafted Pre-Phylloxeric Selection

> Cabernet Sauvignon and Malbec

> Gualtallary, Uco Valley

> Calcareous soil with gravels

> 12 hectares

> Planted in 1992

> Altitude: 1450 meters a.s.l

Nicasia Cru

Ungrafted Malbec Pre-Phylloxeric

> Malbec and Cabernet Franc

> Paraje Altamira, Uco Valley

> Large gravel mixed with sand and loam

> 9 hectares

> Planted in 1996

> Altitude: 1095 meters a.s.l

More Information